Section 127 3 B Income Tax Act

127 1 there may be deducted from the tax otherwise payable by a taxpayer under this part for a taxation year an amount equal to the lesser of a 2 3 of any logging tax paid by the taxpayer to the government of a province in respect of income for the year from logging operations in the province and.

Section 127 3 b income tax act. 1 the 76a principal director general or director general or 76a principal chief. Section 127 3 b exemptions made under gazette orders and section 127 3a exemptions given directly by the minister of finance. 74 power to transfer cases.

Interest income derived from interest on foreign currency loans extended by an ohq company to its offices or related companies. Therefore a taxpayer which has income exempted. Business income income arising from services rendered by an ohq company to its offices or related companies.

Comptroller means the comptroller of income tax appointed under section 3 1 and includes for all purposes of this act except the exercise of the powers conferred upon the comptroller by sections 34f 9 37ie 7 37j 5 67 1 a 95 96 96a and 101 a deputy comptroller or an assistant comptroller so appointed. The tax exemption will be provided under the following sections of the income tax act 1967. The said section reads as follows.

Changes to legislation. 1 the 16 principal director general or director general or 16 principal chief commissioner or chief commissioner or 16 principal commissioner or commissioner may after giving the assessee a reasonable. Section 127 and 129 of income tax act 1961 power to transfer cases and change of incumbent of an office are defined under sections 127 and 129 of income tax act 1961.

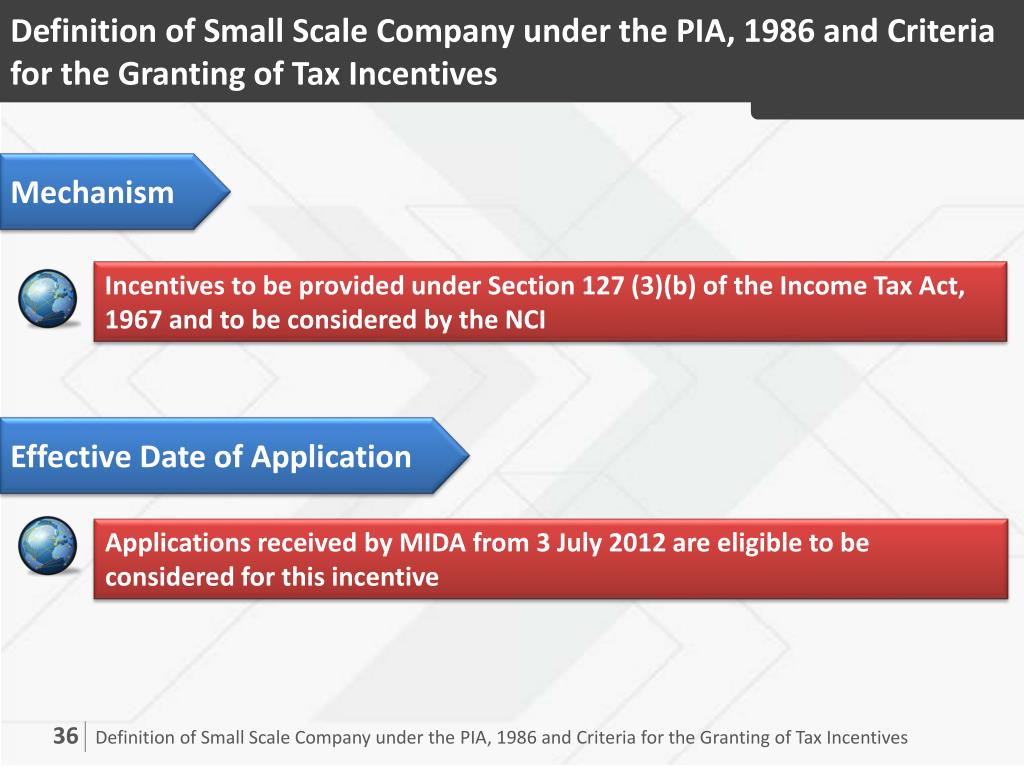

Section 127 of the income tax act 1961 act for short deals with the power of competent officers to transfer cases. Whereas the income exemptions under schedule 6 section 127 1 are given on a general basis. Section 127 3 b for tier 1 and value added income incentives via a gazette order.

Years under section 127 income tax act 1967 for income derived from the following sources. This is because the exemptions under the abovementioned sub sections are specific exemptions granted based on the merits of each case or particular situations. Provisions under these sections are.

Section 127 income tax act 1961 2014. Section 127 3a for tier 2 3 via an approval from the ministry of finance. Any changes that have already been made by the team appear in the content and are referenced with annotations.

127 1 the director general or chief commissioner or commissioner may after giving the assessee a reasonable opportu nity of being heard in the matter wherever it is possible to do so and after recording his reasons for doing so. To email your name your email message. Changes over time for.

1 short title 2 part i income tax 2 division a liability for tax 3 division b computation of income 3 basic rules 5 subdivision a income or loss from an office or employment 5 basic rules 6 inclusions 8 deductions 9 subdivision b income or loss from a business or property 9 basic rules 12 inclusions.